Introduction

In a significant move toward digital transformation, Google Wallet has officially launched in Pakistan. This development marks a pivotal moment for the country’s financial ecosystem, offering millions of users a seamless, secure, and convenient way to manage their payments and transactions. With the introduction of Google Wallet, Pakistan joins the growing list of countries embracing digital wallets as a mainstream payment solution. This article explores the features, benefits, and potential impact of Google Wallet’s launch in Pakistan.

What is Google Wallet?

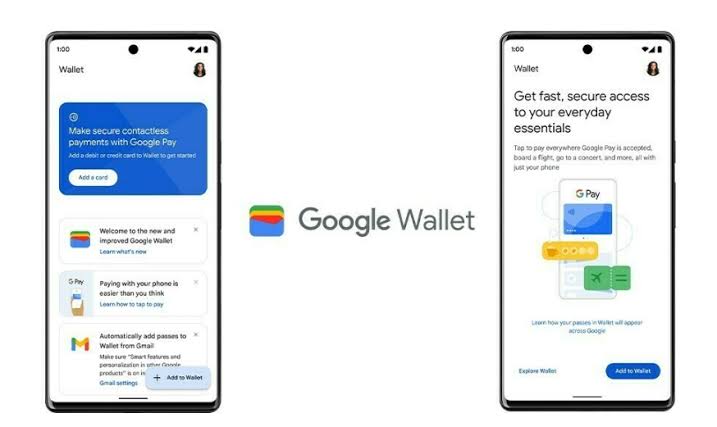

Google Wallet is a digital payment platform developed by Google that allows users to store debit cards, credit cards, loyalty cards, and even event tickets in a secure, virtual environment. It enables users to make contactless payments, send or receive money, and manage their finances through their smartphones. Google Wallet is designed to simplify everyday transactions, making it easier for users to pay for goods and services without the need for physical cash or cards.

The platform leverages Near Field Communication (NFC) technology, allowing users to tap their phones at payment terminals to complete transactions. It also integrates with other Google services, such as Gmail and Google Pay, to provide a unified experience for users.

Google Wallet’s Entry into Pakistan

Pakistan’s digital payment landscape has been evolving rapidly over the past few years. With a population of over 240 million people and a growing smartphone penetration rate, the country presents a lucrative market for digital payment solutions. The launch of Google Wallet in Pakistan is a testament to the increasing demand for cashless transactions and the government’s efforts to promote financial inclusion.

Google Wallet’s entry into Pakistan comes at a time when the country is witnessing a surge in e-commerce, online banking, and mobile wallet usage. The State Bank of Pakistan (SBP) has been actively encouraging the adoption of digital payment systems to reduce the reliance on cash and improve financial transparency. Google Wallet’s arrival is expected to accelerate this shift, providing users with a reliable and user-friendly platform for managing their finances.

Key Features of Google Wallet

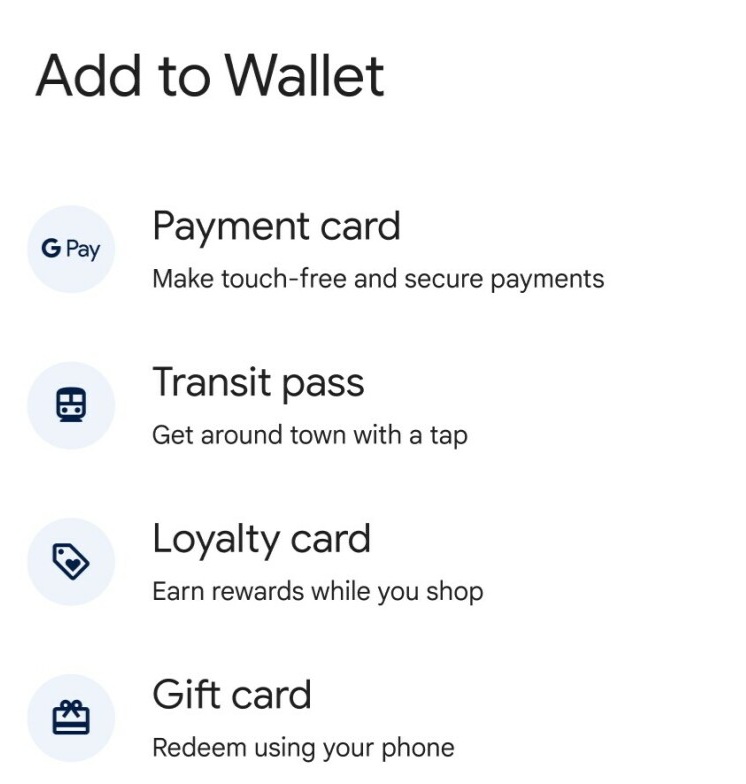

Google Wallet offers a range of features designed to enhance the user experience and streamline financial transactions. Some of the key features include:

- Contactless Payments: Users can make payments by simply tapping their smartphones at NFC-enabled payment terminals. This feature is particularly useful for quick and hassle-free transactions at retail stores, restaurants, and other establishments.

- Secure Storage: Google Wallet uses advanced encryption and security measures to protect users’ financial information. It also requires biometric authentication (such as fingerprint or facial recognition) or a PIN to authorize transactions, ensuring that only the user can access their wallet.

- Integration with Banks and Cards: Google Wallet supports integration with major banks and card networks in Pakistan, allowing users to link their debit and credit cards to the platform. This makes it easy to manage multiple payment methods in one place.

- Peer-to-Peer Payments: Users can send and receive money from friends and family directly through Google Wallet. This feature is ideal for splitting bills, sharing expenses, or sending gifts.

- Loyalty Cards and Offers: Google Wallet allows users to store loyalty cards and access exclusive discounts and offers from participating merchants. This feature helps users save money while enjoying a seamless shopping experience.

- Event Tickets and Boarding Passes: In addition to payment cards, Google Wallet can store event tickets, boarding passes, and other digital passes. This eliminates the need to carry physical tickets and ensures that users have all their important documents in one place.

Benefits of Google Wallet for Pakistani Users

The launch of Google Wallet in Pakistan brings numerous benefits for individuals, businesses, and the economy as a whole. Here are some of the key advantages:

1. Convenience and Accessibility

Google Wallet eliminates the need to carry physical cash or cards, making it easier for users to make payments on the go. With just a smartphone, users can access their payment methods, loyalty cards, and tickets, simplifying their daily routines.

2. Enhanced Security

Digital wallets like Google Wallet offer a higher level of security compared to traditional payment methods. The use of encryption, biometric authentication, and tokenization ensures that users’ financial information is protected from fraud and unauthorized access.

3. Financial Inclusion

Google Wallet has the potential to bring millions of unbanked and underbanked individuals into the formal financial system. By providing a simple and accessible platform for digital payments, Google Wallet can help bridge the gap between traditional banking services and the underserved population.

4. Boost to E-Commerce

The rise of e-commerce in Pakistan has created a need for reliable and efficient payment solutions. Google Wallet’s integration with online platforms can facilitate smoother transactions, encouraging more people to shop online and boosting the growth of the digital economy.

5. Cost Savings for Businesses

For businesses, adopting Google Wallet can reduce the costs associated with handling cash and processing card payments. It also opens up new opportunities for merchants to attract tech-savvy customers and offer personalized promotions.

6. Environmental Impact

By reducing the reliance on physical cash and paper-based transactions, Google Wallet contributes to environmental sustainability. Digital payments generate less waste and have a lower carbon footprint compared to traditional payment methods.

Challenges and Considerations

While the launch of Google Wallet in Pakistan is a positive development, there are certain challenges that need to be addressed to ensure its widespread adoption:

- Digital Literacy: A significant portion of Pakistan’s population may not be familiar with digital payment systems. Educating users about the benefits and functionality of Google Wallet will be crucial for its success.

- Internet Connectivity: Reliable internet access is essential for using Google Wallet. In areas with poor connectivity, users may face difficulties in completing transactions.

- Merchant Adoption: For Google Wallet to gain traction, it is important to onboard a large number of merchants and retailers. Encouraging businesses to adopt NFC-enabled payment terminals will be a key factor in the platform’s growth.

- Regulatory Compliance: Google Wallet will need to comply with local regulations and work closely with the State Bank of Pakistan to ensure a smooth and secure payment ecosystem.

The Future of Digital Payments in Pakistan

The launch of Google Wallet is a significant milestone in Pakistan’s journey toward a cashless society. As more people embrace digital payment solutions, the country is likely to witness a transformation in its financial landscape. The integration of advanced technologies, such as artificial intelligence and blockchain, could further enhance the capabilities of platforms like Google Wallet, offering users even greater convenience and security.

Moreover, the success of Google Wallet could inspire other global players to enter the Pakistani market, fostering healthy competition and innovation in the digital payment sector. This, in turn, will benefit consumers by providing them with a wider range of options and better services.

Conclusion

The launch of Google Wallet in Pakistan is a game-changer for the country’s digital payment ecosystem. By offering a secure, convenient, and versatile platform for managing finances, Google Wallet has the potential to revolutionize the way people make payments and conduct transactions. As Pakistan continues to embrace digital transformation, initiatives like Google Wallet will play a crucial role in driving financial inclusion, boosting economic growth, and improving the overall quality of life for its citizens.

With the right infrastructure, education, and regulatory support, Google Wallet can become an integral part of everyday life in Pakistan, paving the way for a brighter and more prosperous future. The journey toward a cashless society has just begun, and Google Wallet is leading the charge.